Profit of the year margin formula

Ive been selling for almost seven months now and after all my expenses including the fabulous VAT rate of 20 my profit margin is around 14-15 per product line sometimes as. Learn how this formula is used in financial statements.

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Following is the income statement of ABC Company for the year ended 31.

. You can work out the profit margin ratio by deducting the total expenses from the total revenue and then dividing this number by total costs. Net profit margin 440000 - 300000 400000 035 35. This means that 35 is the gross profit margin of the company for the current year.

You had total expenses of 300000. This is a pretty simple equation with no real hidden. A good margin can vary considerably by industry.

This also implies that 65 of the companys profits made up for the cost of goods sold. When this is added to the 19248. The gross profit margin formula offers businesses a way to tally up and keep track of profits.

Formula To calculate net profit margin. Still as a general rule a 10 net profit margin is considered average a 20 margin is considered high or goo and a 5. Net Profit Margin Net Profit Total Revenue.

The profit margin formula is further divided into two formulas of gross profit margin formula and net profit margin formula which are explained below the profit margin formula. For the fiscal year 2021. Divide net income by revenue.

The gross profit margin for the. The formula is Total Revenue -. The net profit margin formula is calculated by dividing net income by total sales.

For example if the company earned 100000 in net income in 2021 and its revenue was 200000 you first divide 100000 by 200000 which yields the number 05. Returning to the example of the shoe company with a 329 profit margin imagine that it spends 43 million on non-operating expenses. Profit Margin Profit Metric Revenue Typically profit margins are denoted in percentage form so the figure is then multiplied by 100.

Following is the formula to calculate net profit margin. This means that for every 1 of revenue the business made 035 in net profit. Here are the steps you can follow to calculate net profit margin.

To calculate gross margin subtract Cost of Goods Sold COGS from total revenue and dividing that number by total revenue Gross Margin Total Revenue - Cost of Goods.

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Entrepreneurship Archives Napkin Finance Financial Literacy Lessons Finance Investing Small Business Planner

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

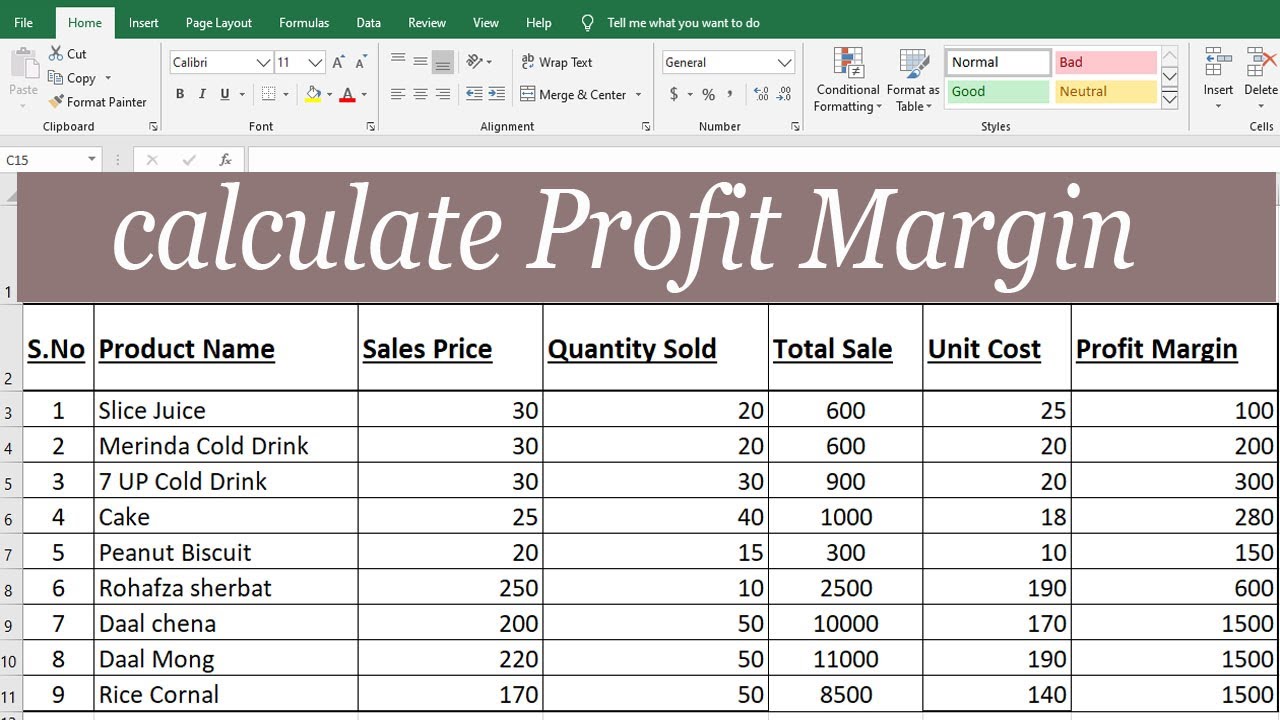

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

How To Calculate Gross Profit Margin 8 Steps With Pictures Profit Profitable Business Cost Of Goods Sold

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

Making Budget Vs Actual Profit Loss Report Using Excel Pivot Tables Budgeting Excel Excel For Beginners

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing